Unlocking the Hidden Potential of the Wisconsin Retirement System (WRS): After-Tax Contributions

Boost your Wisconsin government employee pension through after-tax contributions.

The Hidden Risks and Rewards of Retirement with Karen Carr

Discover the power of viewing retirement as a rebirth instead of an ending with retirement coach Karen Carr.

The Top 5 Regrets of the Dying: How to Live a Life with No Regrets

Reviewing Bronnie Ware’s “The Top Five Regrets of the Dying: a Life Transformed by the Dearly Departing”.

Investing in 2025: Sensible Market Strategies with Joseph Hogue

Unlocking the power of relationships to enrich your retirement and reap the health & wealth benefits of social fitness with Susan Hogan.

Estate Planning 101 in 2025: More Than Just a Will

Learn how to comprehensively plan your estate and ensure your life’s work goes where you want it in the end.

Curing Retirement Loneliness: How to Stay Connected and Thrive

Unlocking the power of relationships to enrich your retirement and reap the health & wealth benefits of social fitness with Susan Hogan.

2025 Retirement Changes: Super Catch-Up 401(k) Contributions Explained

Evaluating Morningstar’s latest research on safe withdrawal rates and suggestions for how to make your retirement last for 2025 and beyond.

Research Suggests Slashing the 4% Rule for 2025

Evaluating Morningstar’s latest research on safe withdrawal rates and suggestions for how to make your retirement last for 2025 and beyond.

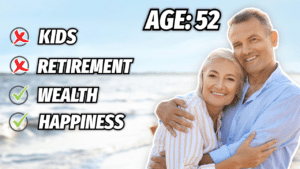

Finding Freedom: A Childfree Approach to Wealth and Retirement

Author and CEO of Childfree Wealth® Dr. Jay Zigmont explains the unique financial planning needs and strategies used in childfree wealth management.

Learn more about retirement, investment and tax planning through our blog updates, as well as our Retirement Revealed podcast, hosted by Jeremy Keil, and published every two weeks. Proud to be named a Top 100 Retirement Blog and a Top 25 Retirement Podcast to follow in 2021 by Feedspot!