Should I take a lump sum payout or monthly annuity from my pension plan?

There is no one answer to this question other than “Do the math, and probably follow the math.”

It’s foolish to believe there is a simple answer to this question, however you can follow a process to decide which action is best for you. It’s going to take some learning, some research, and some good assumptions, but we’ll guide you through it.

Before we get started it’s good to know what you’re up against.

The people who value and monitor pensions are called actuaries. According to the IRS they “assess the financial consequences of risks and use mathematics, statistics and financial theory to analyze and determine the financial impact of uncertain future events.”

Please realize that the math and values that go into and monthly annuity payments from your pension fund are often calculated by highly trained actuaries. Yet the people making the decision for themselves, and the financial advisors guiding them likely don’t have that level of training.

Yet, by the end of this article, you’ll have all you need to decide your answer to “Should I take a lump sum payment or monthly annuity payments?

==

Urgent 2022 Lump Sum Pension Calculation Update

- The way lump sum pension payouts are calculated, and the way interest rates are increasing in 2022 has set up a scenario where your lump sum payment is valued higher than it really should be.

- We are seeing ‘relative value’ calculations of lump sum pension offers at 110% or more right now and encourage you to explore all your options.

- This is the first time in my almost 20 years as a retirement planning focused financial advisor that we have seen this scenario

- Warning: The decision to take a lump sum payout is one you can’t reverse. The financial advisor guiding you through this needs to do complex math around pension valuations, tax planning, and life expectancy estimates

- Caution: The financial advisor recommending you take a lump sum pension payout will probably get a commission or fee that is higher than the payout if they recommend you take the monthly annuity payout. That said, a good financial advisor will review with you all the math, all the options and will make a recommendation based on what is in your best interests.

==

If you listen to most financial articles, you will think that no one in the United States has access to a pension plan anymore. Yet, many people, especially in their 50s and 60s, are still part of a pension system, whether it’s as active members in a current defined benefit plan or as a retiree from their former employer’s retirement plan.

This pension could pay out a guaranteed monthly income and just might be one of your biggest financial assets. Learning your options and making the best choices could make or break you $10s of thousands, if not $100s of thousands of dollars as a retiree!

Read below for key ways to maximize your retirement benefit and especially to answer the question “Should I take a lump sum pension payout or monthly annuity payments?”

When you ask, “Should I take a lump sum pension payout or monthly annuity payments?” you should really break it down to “When should I take my pension?” and “How should I get my pension?”

When should I take my pension?

Most people believe that the day they retire is the day they should take their pension, yet those two dates are often not connected.

Think about if you have an old pension and switched to a new job. You didn’t start that pension just because you left your prior employment! Why would you automatically assume that you need to start your pension when you leave your last employment before retiring?

Think about Social Security, too – you don’t ‘have to’ start Social Security the day you retire. In the same way, you often don’t ‘have to’ start your pension the day you retire.

You should retire when you want to and can afford to.

You should take your pension when it gives you the most expected money over your expected lifetime.

It very well could be that you are better off taking an old pension before you retire.

It could very well be that you are better off waiting a few months, or years, to start your current pension.

Before you decide when to take your pension, you need to learn how a pension works.

Typically, a pension will promise you a specific dollar amount every month for the rest of your life, starting at a normal retirement age.

Remember that it is ‘your life’ and remember that it is ‘normal’ retirement age.

Thankfully most pensions will allow you some ability to choose if you take that promised dollar amount based only on your life, called a single life annuity, or over the life of you and another person (most likely your spouse).

Normal Retirement Age and Early Retirement options

Typically, a pension will allow you to take your monthly payout early, perhaps even 10 years early. Your annual pension would be lower, but you get the money earlier. You need to weigh the value of taking the money earlier vs. taking the higher payout later. A good financial advisor will be able to do the math to assess this pension decision and explain it to you in an easy-to-understand manner.

Here is a common example: Your Normal Retirement Age is 65, You can take it up to 10 years early and for every year you take it early, the monthly pension payment would be 5% lower.

That doesn’t sound too bad, does it? Its only 5 percentage points. But think of someone who is 55 and gets 50% of the promised benefit. Then think of that person at 56 when they could get 55% of the promised benefit. That 5% more, when you are starting at a base of 50% is a 10% higher payout!

That earlier example would be $2000 at an age 65 Normal Retirement, $1000 at 55, and $1100 at 56: you can see how waiting that one year could be very beneficial. It’s hard to turn down 10% more pension income for the rest of your life!

Now that was a common example, but it’s not the only example out there.

We have seen Normal Retirement Ages of 62, 65, 67 and anywhere in between.

- Action: You need to find out your pension plan’s Normal Retirement Age

We have seen pension plans that drop by that standard 5% per year, and we’ve also seen ones that drop by 2% per year, or 6.67% per year, or anywhere in between. Those are large differences!

- Action: You need to find out how much your pension drops when you take it early

We have seen pension plans that max out at their Normal Retirement Age, and others that keep on growing until age 70, or even 72!

- Action: You need to discover if your monthly pension amount stops growing at Normal Retirement Age or keeps on growing!

You might still be working, thinking your pension grows when it doesn’t! Or you might retire and take your pension, just before its value starts growing at an amazing rate!

Joint Survivorship Pension Options

Spreading your pension over the lives of two people would be called your ‘joint survivorship’ option and you often can choose anywhere from a 50% joint survivorship up to a 100% joint survivorship, with steps in between. The percentage shows how much of your pension will keep paying to your survivor if you die first.

A common example might be that you could get $2000 per month, but if you die your spouse gets $0. Or with the 100% survivorship pension you would get $1700 per month and if you died first your survivor (typically your spouse) still keeps getting the same $1700 per month for as long as they live.

You would get less while there are two of you, but it serves as a form of life insurance in that it makes sure your pension payment continues on for the surviving spouse.

How Should I Take my pension?

How you take your pension will depend on many different factors, including:

- Your life expectancy

- As well as your spouse’s life expectancy

- and a key factor called ‘joint life expectancy’

- Your need for guaranteed monthly lifetime income

- What other lifetime income sources you have available

- What other retirement savings accounts you own

Here are the big pension decisions

- Do I take the lump sum amount or monthly annuity payments?

- If I take a monthly annuity:

- When should I take it (now or later)?

- How should I take it (which survivorship option to take)?

- If I take a lump sum:

- How do I invest it?

- Do I find a way to guaranty any of those investments, or their income?

Before you are able to make these big decisions, you’ll need all the proper information:

1. Discover Your Life Expectancy

Most people underestimate their life expectancy, often by a factor of about 5 years (Stanford Center on Longevity: Underestimating Years in Retirement). This is due to a variety of factors including:

- Basing their longevity estimate on what is reported in the newspaper for ‘average life expectancy.

- That is an estimate of newborns, not retirees

- You weren’t born yesterday!

- That is an estimate of newborns, not retirees

- You have survived longer than many others who were included in the averages

- That’s why longevity experts say, “the longer you live, the longer you live!

- Think about it, if life expectancy is 80, and you reach 80, what is your life expectancy? It’s not 0!

- Basing their longevity estimate on what they have seen with older relatives.

- We hear all the time “the men in my family die at (pick a number).”

- You have 40+ years of medical advances on your grandpa!

- And he might have fought in WW2, started smoking and drank too much

- Does all of this apply to you? And even if it does, you still have 40+ years of medical advances on your grandpa, and ~20 years on your uncles!

- We hear all the time “the men in my family die at (pick a number).”

- Not understanding ‘joint life expectancy.’

- If you’re a couple think about it – it’s harder for 2 people to die, than 1 person to die.

- Your pension decision is closely related to whether either one of you is living, not whether one specific person is living

- We often see this ‘joint life expectancy’ at 3-5 years longer than the one individual who is expected to live longer (often the younger, healthier female)

- If you’re a couple think about it – it’s harder for 2 people to die, than 1 person to die.

- Action: You need to get a personalized life expectancy calculation like the free one available at LongevityIllustrator.org

- Pay special attention to your joint life expectancy as that shows how either one of you might still be living.

2. Your Need For Guaranteed Monthly Lifetime Income

When you are deciding on how to take your pension think through how it will feel to no longer have a consistent salary. Most people prefer knowing they will get money coming into their bank account every month. Thankfully most people have Social Security, and you also have a pension that could be a guaranteed lifetime income.

One commons suggestion is to make sure all of your fixed expenses are covered by guaranteed income sources. If you have $5,000 per month in fixed expenses, then you may want $5,000 per month in guaranteed income sources.

Another way to think of it is ‘how much of my monthly income do I want guaranteed?’ Perhaps you’d feel most comfortable if half of your monthly income is guaranteed. Maybe you’d prefer more, or less.

Review the other lifetime income sources you have available

After deciding how much guaranteed monthly income you would want you then do what you can to get the most guaranteed monthly income for the least cost.

Typically, that involves trying to boost Social Security (internal links) as best you can. For recommendations on how to do that go here (links), but in general you would want to take the highest Social Security benefit you have available and wait as long as you can, perhaps even to age 70.

Now don’t worry about waiting 1 to 4 to 8 years on your Social Security and think, “I don’t have guaranteed income coming in right now.” You can adjust your investments to have that income set aside for that short time frame as you wait on Social Security.

What’s more important is that you would have a higher amount, that is at least partially tax-free, adjusts every year with inflation, and lasts for as long as either person in the couple is living. If you did that life expectancy calculator you would know that its very likely, you’ll live longer in the unknown last part of your retirement than the up-front 1-8 years that you might delay Social Security.

Next you would want to optimize your pension. If you still need guaranteed monthly income, you would look at the monthly income amounts offered by your pension and find the age that gives you the best value. Or you would find the age that gives you the highest payout if you take some or all of your lump sum pension and put it into a guaranteed payout annuity through a private company.

What other non-pension investment accounts you own

Thankfully you have probably saved well, in addition to having a pension and social security. Your other investments need to be coordinated with your pension decision. If you have a lot of investments already you may prefer to get the guaranteed monthly payouts of a pension. Your monthly pension annuity would take some stress off of your investments because you don’t need to rely on them as much.

Now most people prefer to take their pensions and Social Security early and wait to take money out of their retirement accounts. This is a natural inclination because you’ve worked hard to save for your retirement accounts, and you’d hate to see the balances go down over time.

But you’ve also worked hard to get a pension and Social Security. You should be getting the most out of your pension and Social Security, just like you want to get the most out of your 401(k), IRA and investment accounts.

The best way to manage your retirement income is to coordinate when you take your pension and Social Security with when you take your investments. The natural inclination is to rely on your pension and Social Security at the beginning of retirement and to rely on your investments later on in retirement, especially when forced to take money out with Required Minimum Distributions.

In order to coordinate all your investment and income sources please consider what if you did the opposite. What if you relied on your investments more at the beginning of retirement and relied on your pensions and Social Security more at the end of retirement?

One advantage pensions and Social Security have over investments is that they will last as long as you do. One of the biggest retirement fears and risks is running out of money. Increasing your pension and Social Security helps take care of that big unknown.

One advantage Social Security has over investments, especially 401(k) and Traditional IRA accounts is that at least part of it is tax-free. Right now, a minimum of 15% of your Social Security is tax-free, perhaps more, at the federal level. Many states, including Wisconsin, don’t tax Social Security either

Another advantage Social Security has over investments is that it is guaranteed to adjust with inflation. Another big concern that retirees have is that their income won’t keep up with inflation. Social Security is designed to do just that!

When you’re considering when to take your pension, you can’t ignore the decision of when to take your investments and when to take your Social Security.

Yes, it feels better to get that guaranteed lifetime income from pensions and Social Security right away and it feels better to wait on taking money out of your retirement accounts.

But, in order to plan for retirement well you need to run the numbers (we’ll walk you through it below), consider all the risks, especially around how long you might live, how bad inflation might be and how much the market could drop, and coordinate your pension, social security and investment decisions together.

Here are those big decisions from earlier:

1. Do I take a lump sum pension payout, or monthly annuity payments?

That answer is going to depend on a lot of factors, especially around longevity (discussed previously), but to really get to the answer you need to determine if you’re getting a fair deal for your lump sum pension payout.

Think about it. How do you compare a lump sum payout one time with a series of payments that last your whole lifetime? They are two seemingly different things and honestly that big onetime payment looks really tempting! Think of how many lottery winners take the cash value over the long-term annuity!

Consider what you do when you travel overseas. You look at an exchange rate to see what your dollars are worth in another country. Once you know that exchange rate you can learn the price of things in US dollars and really decide if that object, priced in the foreign currency, is worth the money or not.

It’s the same thing when comparing your lump sum pension offer and your monthly annuity payments. You need to translate the monthly annuity payments into something called a ‘present value’ so you can compare the relative value of each option. You can’t compare the values until you are looking at the same currency – in this case the present value, in today’s dollars, of all the future monthly annuity payments compared to the present value, in today’s dollars of the one-time lump sum payout.

But how do you translate that monthly annuity payment into a present value? You need estimates of longevity and estimates of interest rates over your whole retirement. You would need a probability distribution of all the different mortality dates and future interest rate possibilities.

Thankfully you’re not alone.

There are two ways you can determine the value of your monthly pension annuity quite easily.

Relative Value Comparisons

Hopefully you can get something called a Relative Value Comparison ahead of time. Ideally you would get it for every possible pension start date, but I doubt that will happen. You should definitely get it when you are mailed your pension filing paperwork packet from your company.

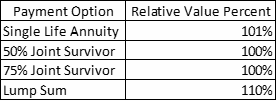

Here is a recent one we saw in 2022:

Notice how the monthly payout options are worth relatively the same. That’s really what you want to see. You want to know that the way you fill out a form shouldn’t really lose you any money from your pension.

Notice, too, that the Lump Sum has a relative value that’s 10% higher than all the other options! We typically see the lump sum at close to 100% relative value, so this is a strong indication that in 2022 lump sum pensions are worth more than usual.

These relative value calculations are based on IRS interest rate assumptions interest rates that we have felt didn’t match market interest rates for close to 20 years. When we saw a relative value of 100% for the lump sum, we would do our own math based on actual real-time interest rates and often see that lump sums weren’t as valuable as the monthly amounts. Often, the monthly payout values were worth 10%, 20% or even 50% more!

And yet in 2022 we are seeing charts that are very similar to this one, where the IRS interest rates are calculating the lump sum as being worth 10% more than the monthly payout annuities, and our calculations using actual real-time interest rates are suggesting that the lump sums could be worth even 20% more than the monthly amounts.

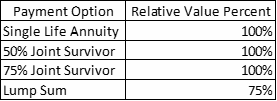

Now you can’t extrapolate one chart to all pensions at all times. Here is a relative value chart we saw a few years back from a lump sum pension offer. This is an offer that is sent to former employees encouraging them to take their lump sum pension vs waiting and taking a monthly annuity later on.

Check out the value of the lump sum – it’s 25% less than every other option. We have found that it’s a common situation to see the lump sum pension offer being worth less than the monthly annuity options – but this one was extreme! And the info was right there in the packet sent to him without any further math needed (although we do encourage you to run the math).

Now how do you do the present value math on your own?

As we learned earlier about actuaries it takes “mathematics, statistics and financial theory to analyze and determine the financial impact of uncertain future events.” How can you possibly do that without being an actuary yourself?

Thankfully there is an easy way to determine the value of your monthly pension annuity. You just need a publicly available income annuity estimator that will tell you the price, or present value, it takes to generate a certain level of income using today’s market rates, based on the different probabilities of longevity.

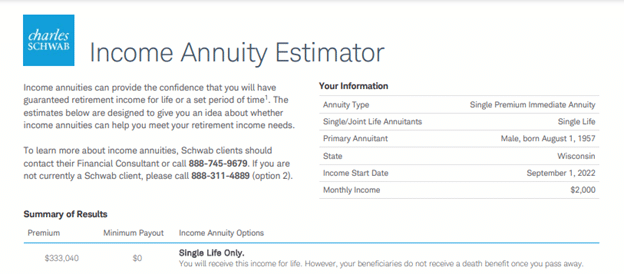

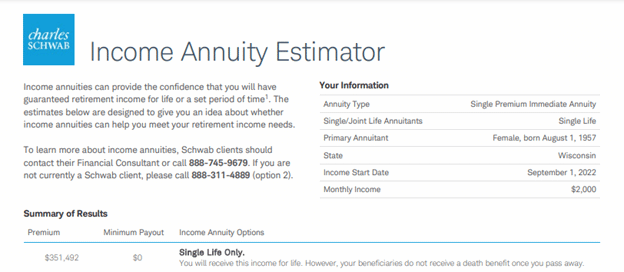

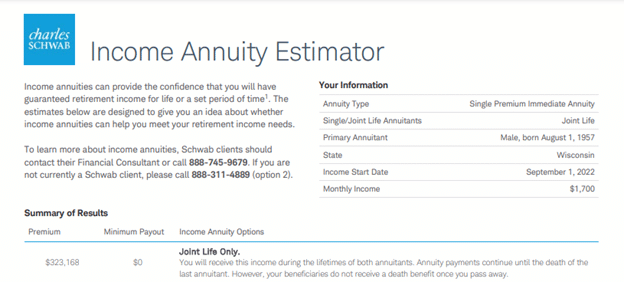

Here’s one through Schwab: Fixed Income Annuity Calculator

You will want to plug in your birthdate, the income amount you are promised from your pension and then choose if it’s a single life annuity (just you) or a 100% joint survivorship annuity (you and your spouse).

Here is what we see for 65-year-olds in August 2022:

A 65-year-old male would need $333,000 to generate a $2000 per month single life annuity.

A 65-year-old female would need $351,000 to generate $2,000 per month in income.

A 65-year-old male & female couple would need $323,000 to generate a joint 100% survivorship monthly annuity of $1700 per month.

Now that you have the value of the single life annuity and the joint life annuity you can determine if the lump sum pension offer is a good deal or not.

If you’re married and your monthly annuity is valued at $323,000 and the lump sum pension offer is $300,000 then you can see that your monthly annuity is worth about 8% more than what they offered, you with a lump sum.

If you’re a single female and your monthly annuity is valued at $351,000 and the lump sum pension offer is $400,000 then you can see the lump sum is worth about 14% more than the monthly annuity.

Now that you have determined the different values of your monthly annuity (both as a single life annuity and a 100% joint survivorship) and compared it to today’s lump sum pension offer, you’ll want to go through each different age and calculate out the value of the monthly amount, compared to the projected lump sum amounts.

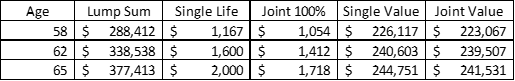

Here is a recent example from summer 2022:

How hard is it to decide taking $1167 per month as a single life, or $1,054 as a joint life, or $288,412 as a lump sum? Crazy hard unless you translate the value of the monthly payments into the present value through an income estimator like Schwab’s Fixed Income Annuity Calculator.

You’ll see that the value of the single life annuity and the joint life annuity are relatively the same. That’s what you’d like to see. You shouldn’t really be losing any value just by how you check a box.

Also notice that the lump sum value of $288,000 today is roughly 28% higher than taking the monthly payments. It’s even 19% higher value to take the lump sum today vs. waiting until age 65 to take the monthly annuity.

Seeing that the lump sum value is greater doesn’t automatically mean you should take the lump sum out. You might have other reasons to take the monthly annuity.

And if it were the opposite (like we’ve seen the past 20 years) that the monthly annuity is a better value than the lump sum doesn’t automatically mean you should take the monthly annuity.

But doing the math and seeing the math often encourages you to follow the math.

2. When Should I Take My Monthly Annuity?

You should take your monthly annuity when it gives you (and your spouse) the highest expected payout over your lifetime. Gather all the information and put it into a chart to determine when its best to start your monthly pension

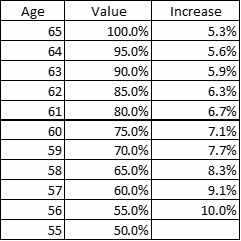

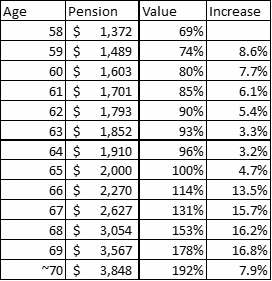

You may have the actual numbers from your pension projections, or you may just have the information from the Summary Plan Description. We would encourage you to make use of the pension projections if you can as it could be hard to tell if your pension keeps increasing past your normal retirement age just by looking at your Summary Plan Description. Here are some examples of what this could look like:

Notice how we added a 3rd column to track the increase in income for each year of waiting. You’ll typically see the first two columns in your Summary Plan Description, and we encourage you to add the third column to get a better sense of the value of each year of waiting on taking your pension.

This person has a pension that is the standard drop of 5 percentage points for every year below the Normal Retirement Age. Now 5 percentage points means different things every year. Waiting from 55 to 56 is really a 10% increase – it’s hard to turn that down! Waiting from 64 to 65 is only a 5.3% increase. That’s still a nice increase, but not nearly as much as waiting for the first year on the pension.

To compare it to Social Security, usually waiting from 64 to 65 would be roughly a 8% increase so if this person truly needed the income, they might feel comfortable taking the pension one year earlier and waiting on Social Security at least one year.

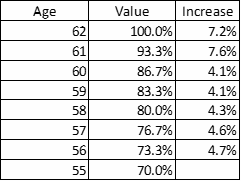

This person has a Normal Retirement Age of 62. They would be wise to confirm that the pension truly maxes out at 62. We’ll show you an example next where it continues on, with staggering results!

Notice how the pension only increases in the 4-percentage point range from 55 to 60. If the individual is already retired, they might feel comfortable taking the pension at 55 or 56 or 57. If they retire at 62, they would want to take it right away since they’ve already hit the max, but if they retire around age 60, they might be better off waiting until 62 to take the pension to capture those last two years of big increases. Social Security increases at roughly 7.4%/yr from 62 to 70 which is a good indication that the increases from 60 to 62 are a good deal.

Thankfully this person was able to project out how their monthly benefit would grow all the way to its max of almost age 70. They tried age 70 and it didn’t work, so they tried age 69 and 11 months and they could project their benefit for that amount.

Having those pension numbers by age gives them a better indication on how their pension works than even the charts that are in their Summary Plan Description!

Notice how waiting from 58 to 60 gives some nice increases that are in the Social Security range of 7.4%/yr.

Notice how waiting from 62 to 65 doesn’t seem to give a large growth amount.

Then notice the staggering increases that occur with every year they wait past age 65! Increases of 13-17% are virtually unheard of! Notice how the benefit at almost age 70 is a little more than double the benefit at age 64.

Now this individual has an interesting decision. He might retire at 62 and his friends would probably think he’s crazy to wait on his pension for up to 8 years, yet his monthly benefit would more than double!

If the common encouragement with Social Security is to potentially wait from 62 all the way to age 70 to file (for a 77% increase) wouldn’t it, make sense for him to consider waiting all the way to 70 on his pension (for a 115% increase)?

These examples show that you need to learn your pension numbers specific to you and rely on the math and probabilities to suggest when you take your pension, not the rumors at work on what is best for your pension.

3. How should I take my monthly annuity (which survivorship option is best?)

Many people try to figure out a ‘break-even’ length of time, or perhaps an interest rate they would need to get to determine which survivorship options are best. Or maybe they figure that one person in the couple is less healthy than the other person, so they want to tilt the payout towards the healthier person.

These are all very reasonable considerations. Let me share with you some observations we’ve made on almost 20 years of discussing pension options with couples:

- Social Security doesn’t have a survivorship option the way pension do.

- You can’t ask Social Security for a lower payout today to get a joint survivorship payout later on

- Because of this, when your pension has a survivorship option available, it makes that survivorship option even more valuable. If you can’t get this option anywhere else then it shows how valuable the higher survivorship options are and would encourage you towards taking the highest survivorship option that you can

- Many people say “what are the odds of (something) happening?” and don’t actually look up the odds.

- Check out Longevity Illustrator and you can actually discover the odds!

- Many people say, “She’s going to outlast me” as if its 100% certain.

- You don’t really know that with certainty, and the survivorship options should take into account age and gender differences

- Although they don’t and can’t take into account your health differences

- But thankfully Longevity Illustrator does!

- Check it out and you might be surprised at the probabilities that the lower health individual might outlive the other spouse.

- You don’t really know that with certainty, and the survivorship options should take into account age and gender differences

While we can’t tell you specifically how to take your pension, what we will say is that the big risks in retirement are related to outliving your money, keeping up with inflation and the difference in income when the first spouse dies and Social Security (and perhaps part or all of your pension) decreases.

All of these factors would tilt the odds towards maxing out the survivorship option as best you can (and also maxing out Social Security the best you can, often by waiting as long as you can on the higher benefit).

4. If I take a lump sum how do I invest it, and do I find a way to guaranty any of those investments or its income?

We get to meet a lot of people when they are faced with these big retirement decisions like taking their pension as a lump sum or a monthly annuity payment. We’ve observed that the general feel is to take the lump sum because then they can control it and if they, or both spouses die, their beneficiaries wouldn’t get any income from the pension.

What’s interesting to me is that when people want to take the lump sum, and are concerned about leaving some of their hard-earned pension to their kids or other beneficiaries they often want to have more guarantees and less risk than their other investments.

This is quite natural – they know that their pension was guaranteed and so they are anchored towards that set up. Keeping that in mind, here are the main options when you invest your lump sum pension payout.

The first thing to know is that you would generally rollover your pension lump sum amount into a Traditional IRA. If you took the pension lump sum as a check paid to you then all the income tax would be due that year and then you’d have to reinvest into taxable accounts. So make sure, if you take your lump sum, to do a direct rollover from your pension company directly into your Traditional IRA.

Now you’ll want to decide how to invest the money. One benefit of taking the lump sum is that you can choose a lot of different options. With a monthly annuity you get all of that value in one company paying you on a monthly basis.

You could invest some money towards guaranteed short-term rates: bank type accounts, or US Treasury Bills, or Multi-Year Guaranteed fixed annuities are common examples. These could all be purchased within your Traditional IRA.

You could invest some money more towards growth with individual stocks or bonds, or more likely mutual funds or Exchange Traded Funds (ETFs) made up of stocks or bonds. If you go this route understand that your investments are not guaranteed, but through diversification and picking the types of funds you could dial up or down your risk level.

In general, for money that you need in the next few years you would tilt towards the short-term interest rate type of accounts. For money you need 5-7 years or longer from now you would tilt towards the longer-term growth type of accounts.

When investing your lump sum pension you should decide how much money you need ‘just in case’ and how much money you plan to take out in the next few years (whatever you decide is your ‘short-term’ level). Actually plan it out by saying, “I need X amount of dollars out over Y amount of years.” This money would be your short-term and you should look for short-term interest rate type of investments.

The next amount of money is easy to figure out – it’s everything else. If it’s not short-term, then it must be long-term! You can take this money and invest it based on your ‘risk tolerance’ otherwise known as your willingness and ability to let your investments go up and down in value. You might already have a mix of stocks and bonds for your non-pension investments and this mixture might work well here.

Here’s what’s interesting about what we’d hear sometimes from people who would say, “I’ll take the lump sum and invest it to make more money than the retirement system.” Our response was to have them look into how the pension assets are invested and its investment return. Oftentimes the way the pension fund invested had a similar growth mixture to the way the person wanted to invest it – except often with lower overall fees and a better track record!

If you’re planning to invest your lump sum pension please first look into how it is invested already, by the retirement fund managers themselves!

Do you find a way to guaranty your lump sum pension?

This is an interesting question, because since 2003 when I first started as a financial advisor the way lump sum pension are valued (it’s based on last years’ interest rates) most commonly caused a lump sum payout to not be as valuable as a monthly annuity payment.

Keep these things in mind:

- Your pension has a mixture of stock, bond and other investments backing the promises made by your company

- Your pension is required to report its ‘annual funding level’ from the past fiscal year, which shows its ability to pay out its promises. Generally, a level of 80%+ is considered good, although you’d really prefer to see closer to 100%

- Your pension is likely backed by the Pension Benefit Guaranty Corporation

We hear people all the time saying they want to take the lump sum pension out because they don’t trust the company backing the pension.

We strongly encourage you to look up the funding level of the pension, evaluate the level of assets and liabilities, and compare the number of active members and retired participants.

You want to make sure there isn’t an unfunded pension liability (which means the defined benefit plan has more promised benefits than it has investments backing those benefits).

Also, check the stock and bond mixture of those investments, and absolutely doublecheck if your pension is backed by the Pension Benefit Guaranty Corporation.

With all that said you may want to guaranty part or all of your lump sum pension and yet still take it out as a monthly payment – just from another place that’s not your pension.

If so, you are likely looking at an investment option called an annuity. Now the word annuity means a lot of things to different people, but the true sense of an annuity is that you hand over control of a large sum of money (typically to an insurance company) and then they begin to pay you back a series of smaller amounts of money (usually monthly or annually) over a length of time (usually your lifetime, or that of you and your spouse).

If you are trying to replace some or all of your monthly pension through an annuity you are likely looking for a ‘single premium immediate annuity’ or a ‘fixed indexed annuity with a lifetime income benefit.’

The Single Premium Immediate annuity would start payments to you right away and could be set up in such a way that if you died before you took out all of the money you invested then your beneficiaries could get the remainder.

The Fixed Indexed Annuity with a lifetime income benefit could start payments right away, or you could wait a few years. It could also be set up so there is some level of death benefit, or account value that would pay out to your beneficiaries if you didn’t fully deplete the account value yourself while living.

Both would be able to provide a guaranteed income to you over your lifetime, if you set it up that way

Both would be ablet to payout as a joint lifetime basis so you and your spouse are protected, if you set it up that way.

Both are complex instruments. You would want to find a good independent annuity agent that can quote multiple companies so that you get the best rates.

They would likely use software by CANNEX or AnnuityRateWatch.

They should be able to explain to you how the investments work and how they compare to the monthly payment from your pension.

They should make you aware of, and help you navigate the coverage of your state’s Life and Health Insurance Guaranty Associations.

And understand that your annuity agent will very likely get a commission for selling you any annuity, and yet probably would not get a commission, or nearly as much, if they suggest you instead take the monthly payments guaranteed by your pension.

Summary: Should I take a lump sum pension payout or monthly annuity payments?

While there is no answer to this question, we have provided you with a framework on how to make the decision between a lump sum pension payout or monthly annuity payments.

In addition,

- you learned how to discover your life expectancy ages and longevity probabilities

- you learned how to translate the value of a pension’s monthly annuity payments to be able to compare the relative value of the monthly annuity vs. the lump sum payout

- you learned how to coordinate your pension decision with your social security benefits and your non-pension investments

- and you learned how to guarantee some or all of your lump sum pension payout if that is important to you.

Choosing when to take your pension, how to take your pension, and how to invest your pension (if taken as a lump sum) is a decision that will impact the rest of your life.

If you need guidance, please send us a message and make use of our 9 step Pension Decision Process

9 Step Pension Decision Process

- Get the “Summary Plan Description” from your pension provider. This will tell you the rules of the pension, especially around normal retirement age and the reduction factors for your monthly pension payment should you take it early.

- Visit the Pension Benefit Guaranty Corporation to determine:

- Is your pension covered?

- What is your pension’s funding level?

- You’d like to see 80%+, preferably 100%

- If your pension is taken over by PBGC what is the monthly amount that is covered

- It’s possible, but not likely your pension is greater than the coverage amount. It’s best to check on it!

- Look at all your available options by year.

- People may retire today but they can often delay when they take their pension, sometimes even past the pension’s normal retirement age!

- Calculate the ‘present value’ of all the available monthly payment options by calculating the cost of buying that monthly payment on your own with a calculator like Schwab’s Income Annuity Estimator

- Compare how waiting on your monthly annuity to a different year would increase your income.

- As well as the relative value of the monthly annuity payment vs. the lump sum pension payout

- Look for patterns on how much the monthly payments and the lump sum grows each year.

- This might suggest an optimum age for taking the monthly annuity or lump sum

- Determine which year and which method (lump sum vs. monthly) is most valuable.

- Decide your survivorship option, if applicable (often between 50% – 100% that stays to the survivor if you decide first)

- Decide how to invest your money if you take it as a lump sum pension payout

- You’ll very likely roll it over into a Traditional IRA

- You may want to invest it for growth

- You may want to guarantee some or all of its income through some sort of annuity

Share:

Listen to Retirement Revealed on: