Lower iBond interest rate? When to Sell I Bonds (2025)

Current 2025 I Bond interest rate rate is 3.11%!

Now that the I Bond interest rates have been dropped to 3% in April 2025 you’re probably wondering, “When should I cash out my I Bonds?”

Chances are you bought your I Bonds at the 0.0% fixed rate in 2021 or 2022, so as they are renewing your rates are coming in below 3%, compared to other interest rate accounts at around 4.5%.

Keep in mind that cashing out in the first 5 years will cause you to lose your prior 3 months’ interest.

Read on to learn more about keeping the most interest you can if you cash out your I Bonds.

What are the I Bond rules?

I Bonds are somewhat simple, but there are a couple nuances that will make determining when to cash out your I Bonds a little tricky.

- I Bonds earn interest for up to 30 years

- I Bonds have a fixed rate that stays with it the life of the bond

- I Bonds have a variable rate, based on inflation, that resets every 6 months

- You can NOT cash out your I Bond for 12 months after purchasing

- If you cash in the bond in less than 5 years, you lose the last 3 months of interest

A lot of your decision on when to cash in your I Bonds has to do with your thoughts on whether I Bond interest rates are going up or down. Here’s our latest thoughts, based on the data.

What is the current I Bond interest rate?

With the November 2024 update, I bonds now carry:

- New Fixed Rate of 1.20%

- New/Renewing Inflation rate of 1.90%

Current I Bond Fixed Rate is 1.2% – near the 18-year high!

The current I Bond Fixed Rate, for new purchases through April 2025 is 1.2% – near the high point since October 2007!

What is important to know when cashing in I Bonds?

The two most important things to know when cashing in I Bonds are:

- Your personal interest rate on the I Bond resets on your I Bond’s individual 6-month reset time frame.

- NOT when new rates are announced in May and November

- For example, if you bought an I Bond in January your bond resets its rate in July and January every year.

- You might hear the new rate announcements in May and November each year, but that rate won’t be effective for your bond until 2 months later in July

- NOT when new rates are announced in May and November

- You lose the ‘last 3 months of interest’ when you cash out that I Bond in the first 5 years

These two facts added together mean:

- When you hear the new interest rate and you’re not happy with it, chances are that new, lower rate isn’t effective for some time until your personal rate resets

- If you don’t like the new interest rate you might want to wait 3 months after your own rate resets before you cash it out

- That way you lose 3 months of the low interest, not your high interest that you liked!

- You might hold the bond for 15 months instead of the 12-month minimum, but you’d keep more interest!

Should I keep my I Bonds?

You might actually want to keep your I Bonds!

- I Bonds are guaranteed to meet or exceed the inflation rate over their 30-year time frame

- You can’t lose your principal investment with I Bonds

If you liked your old I Bonds at 0% Fixed rate, then you might be interested in swapping over to the new 1.2% Fixed rate.

Yet most people that bought I Bonds in 2021 and 2022 were looking more for the short-term great interest rates they offered and weren’t necessarily looking to keep them as a long-term investment.

Where Should I Put My I Bonds Money After I Cash Out?

If you cash out your I Bonds you’re probably thinking, where should I go next with my money?

It’s always good first to consider paying down debt, and reviewing your long-term and short-term goals to make sure you have the right amount of money put towards those goals, using the appropriate investments.

- If you need money in the short-term you should find short-term investments.

Since you already have a Treasury Direct account you may consider Treasury Bills! Learn how to Get More Interest From Buying Treasury Bills (T-Bills) Through Treasury Direct

The I Bonds you purchased probably came from short-term money in your bank accounts, perhaps as part of your emergency fund.

The interest rate environment has changed drastically from the start of 2022. Before you put that money back into your regular account learn 5 Ways To Earn More Interest on Your Bank Money

- If you need money in the long-term you should use long-term investments that are based on the level of risk you’re willing to take.

Make sure you have a process for determining which long-term investments to make. Keep in mind that there are a lot of tax planning decisions that are often connected to investing for the long-run, too.

What is my Tax Rate on My I Bonds Interest?

There is no special tax on I Bonds interest. The I Bond interest gets reported on your 1099-INT and it just gets added in at ordinary income tax rates.

If you cash out your I Bonds keep in mind that you will owe taxes on all the interest you’ve earned since you bought them. You could have claimed your taxable interest each year on your tax return, but that’s highly unlikely.

If you cash out your I Bonds this year, make sure to visit Treasury Direct again during next tax season to download your 1099 and give it to your tax preparer. Here’s a video to learn how to do that:

What Are the Special Tax Rules on I Bonds Interest?

There are two big tax rules related to I Bonds Interest that could save you money on your tax return.

- You might be able to avoid taxes on I Bonds Interest by using it to pay for higher education.

Now there are a lot of rules that come with this benefit, especially around income limits and what counts as “qualified expense” and “eligible institution.”

Make sure to check out the Treasury’s website on Using I Bonds for Higher Education and especially pay attention to the instructions for IRS Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989.

Not only did you get a great interest rate on your I Bonds, but you won’t have to pay state and local income taxes on that interest.

What Was My Rate of Return On My I Bonds?

Your own personal rate of return will depend on both when you purchased the I Bond, and when you cash out.

Keep in mind that you don’t earn interest on your I Bonds until you complete the month, so cash out early in the month. If it’s near the end of the month, plan to cash out after the 1st of next month so you get the interest you’ve earned.

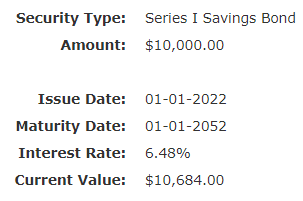

To show you how and when interest is posted on your I Bond, here is a screenshot of a $10,000 I Bond on February 28, 2023.

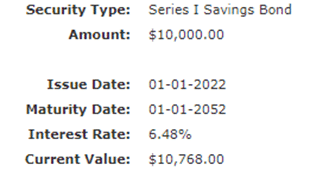

Here is the same bond on March 1, 2023

You can calculate your personal rate of interest using a rate of return calculator like this Annual Rate of Return Calculator

Make sure to account for the extra 3 months that you might be holding on to the I Bonds, in order to keep the prior, higher, interest rate.

You’ll read below on when to cash out your I Bonds, but here are some returns I’ve calculated.

You likely bought I Bonds either between November 2021 – April 2022 to get the initial 7.12% interest, or between May 2022 – October 2022 to get the highest ever 9.62% inflation rate.

- If you bought your I Bonds between November 2021 – April 2022 you will likely hold for 21 months or more. At the 21-month mark your rate of return would be 6.72% over that time frame!

- If you bought your I Bonds between May 2022 – October 2022 you will likely hold for 15 months or more. At the 15-month mark your rate of return would be 6.51% over that time frame!

Clearly, these were great returns for an alternative to bank account money, which is why, when you see the current inflation rate of 1.90% you might start considering when to cash out.

When Should I Cash Out My I Bonds?

When you cash out your I Bonds is going to be based on when you need the money, as well as what the new interest rate will be when your I Bond renews.

Make sure to keep an eye on I Bond inflation rate projections that are available a few weeks ahead of the Treasury’s announcement of new I Bond interest rates in early May and early November.

Remember, when you cash out your I Bonds you don’t earn the interest until you complete the month and that you lose the prior 3 months’ interest.

If you want to keep all your good interest and get the most out of your I Bonds you should cash out:

- after earning 3 months of lower interest and

- just after the 1st of the month.

What’s great about I Bonds is that you can generally see the renewal rate before it affects you and then plan out both when you want to cash out, and where you’ll put your money next.

More I Bonds Resources

- Great Personalized Calculator on when to cash out I Bonds

- CNBC: When to Cash Out I Bonds

- 9 Steps on how buy I Bonds by Jeremy Keil

- A Complete Guide to Investing in TIPS and I Bonds (2022) by David Stein with Money For the Rest of Us

- Podcast: US Series I Savings Bonds Simplified featuring David Enna from TipsWatch.com

- Treasury Direct: Series I Savings Bonds

- 3 Things You Should Know Before Choosing A Financial Advisor

- 7 Questions That Could Make or Break Your Retirement

- Free Retirement Video Course: Your 5 Step Retirement Income Plan

- Subscribe to Retirement Revealed on Google Podcasts

- Subscribe to Retirement Revealed on Apple Podcasts

Connect With Jeremy Keil:

- Mr. Retirement YouTube Channel

- LinkedIn: Jeremy Keil

- Facebook: Jeremy Keil

- LinkedIn: Keil Financial Partners

Disclosures

This material is provided for informational purposes only and is not solely intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The views and strategies described may not be suitable for all investors. They also do not include all fees or expenses that may be incurred by investing in specific products. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. You cannot invest directly in an index. The opinions expressed are subject to change as subsequent conditions vary. Advisory services offered through Thrivent Advisor Network, LLC.

IMPORTANT: Advisory Person(s) may use proprietary financial planning tools, calculators and third-party tools and materials (“Third-Party Materials”) to develop your financial planning recommendations. The projections or other information generated Third-Party Materials regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time. Thrivent Advisor Network, LLC and its advisors do not provide legal, accounting or tax advice. Consult your attorney and or tax professional regarding these situations.

The return assumptions in Third-Party Materials are not reflective of any specific product, and do not include any fees or expenses that may be incurred by investing in specific products. The actual returns of a specific product may be more or less than the returns used. It is not possible to directly invest in an index. Financial forecasts, rates of return, risk, inflation, and other assumptions may be used as the basis for illustrations. They should not be considered a guarantee of future performance or a guarantee of achieving overall financial objectives. Past performance is not a guarantee or a predictor of future results of either the indices or any particular investment. Investing involves risks, including the possible loss of principal.

This communication may include forward looking statements. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,” “anticipates,” “plans,” “estimates,” “projects,” “targets,” “forecasts,” “seeks,” “could’” or the negative of such terms or other variations on such terms or comparable terminology. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially.

Advisory Persons of Thrivent provide advisory services under a “doing business as” name or may have their own legal business entities. However, advisory services are engaged exclusively through Thrivent Advisor Network, LLC, a registered investment adviser. Keil Financial Partners and Thrivent Advisor Network, LLC are not affiliated companies.

Share:

Listen to Retirement Revealed on: