Get More Interest From Buying Treasury Bills (T-Bills) Through Treasury Direct

Now that the Federal Reserve has been increasing interest rates beginning in 2022 and into 2023 you may be wondering why your money market or savings account and certificates of deposit (CDs) aren’t getting more interest.

While the Federal Funds Rate sits at 5.25-5.50%, the average savings account is paying only 0.36% interest (as of August 14, 2024).

Locking your money up for 12 months doesn’t help you keep up with inflation either, since the average 12-month CD rate is at 1.82% (as of August 14, 2024).

What other options do you have to get a higher interest rate on your money market or savings account? What’s the use of compound interest if your bank interest payment is so low you need a microscope to see it?

We’ll look at some options below, but one to consider that might be new for you is Treasury Bills.

August 2024 Treasury Bill Rates

6-month Treasury Bill rates are 4.93%!

12-month T Bill rates are at 4.41%!

The new 17-week Treasury Bill rate is 5.13%!

(Rates as of August 14, 2024)

Start with paying down debt

While the first place to look for great interest is paying down your credit card or other loan accounts, you also need to keep in mind the potential tax benefits from a student loan or mortgage. And with mortgage rates that rose drastically in 2022, and still high in 2024, you may prefer to keep that lower interest rate from the mortgage you got in 2021 or earlier.

But let’s assume you’ve already paid off all the debt you’d like to pay off.

US Series I Savings Bonds

One place that has been popular lately is US Series I Savings Bonds (I Bonds).

If you’ve maxed those out or decided they weren’t right for you, then consider Treasury Bills (T-Bills).

If you’re wondering when to cash out your I Bonds, check out our post When Should I Cash Out My I Bonds?

Now I Bonds have a Fixed Rate of 1.30%, which is a 16-year high!

Look at Short-Term Treasury Bills (T-Bills)

Treasury Bills (T-Bills) are short-term debt issued by the US Government that come due in 1 year or less.

You could buy T-Bills from your broker or other financial institution, but another way is to make a direct purchase through the US Treasury.

How do Treasury Bills work to get you more interest than a money market or savings account?

When you are trying decide on T Bills vs. savings account know that a T bill is not part of the Federal Reserve System like your bank accounts are. T Bill rates are more set by what the market believes about the inflation rate and other rates in the economy.

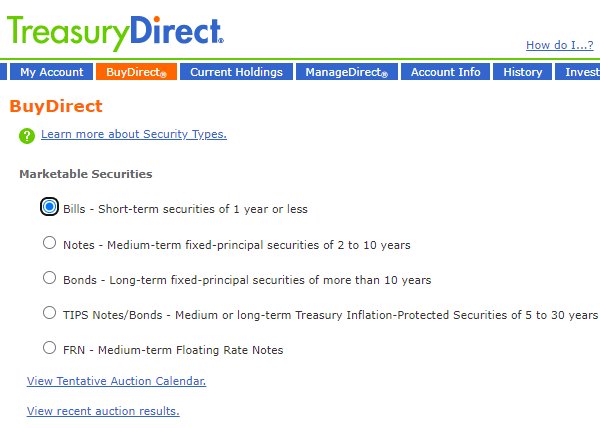

Treasury Bills are known as ‘marketable securities‘ in that they could be bought and sold on the ‘secondary market,’ most likely through a brokerage account.

They work a little different than your savings account, CD, or other type of bank money.

The first thing to know is that they are quoted at a bank discount rate. It’s not like getting interest payments within your bank savings, checking or CD accounts.

How does a bank discount rate work?

Here’s an example. If the bank discount rate is 5% on a 1 year Treasury Bill it’s not like you would invest $10,000 and then see interest payments added daily or quarterly into your Treasury Bill.

Instead, you would buy the T-Bill at a 5% discount, or $9,500 and 1 year later (52-weeks really) the bill would mature, and you would get $10,000.

Since they are quoted at a discount rate, in order to compare a Treasury Bill against something like a CD that has a similar time frame you would have to convert that discount rate over to something known as coupon equivalent rate.

Then you can compare it to something you are more used to called the annual percentage yield (if it’s a savings type investment) or annual percentage rate (if it’s a loan type account).

Here’s the math on a one-year Treasury Bill with a 5% discount rate: $500 interest ($10,000 maturity – $9,500 investment) / $9,500 investment = 5.265% coupon equivalent rate. You’ll notice that the true interest earned on the money invested is a higher interest rate than the quoted ‘discount rate.’

How do you get your money back with Treasury Bills?

If you are buying T-Bills through TreasuryDirect.gov you would need to wait until the Bill matures to get the money out, however if you really needed the money ahead of time you could transfer to your broker or other financial institution and sell the T-Bill on the secondary market.

You’ll get a market price for that T-Bill that includes some of the accrued interest since you bought it, but could also fluctuate up and down depending on what interest rates are doing in the market.

If you want to know the exact fixed interest rate you would get from your Treasury Bill, then you would hold it to maturity. Otherwise, when you do the math, if you sell early, you will see you got a higher interest rate, or lower interest rate than you initially thought.

Now that you know more about how Treasury Bills work you should look into the current T-Bill interest rates and think of how long of a term you want to hold the investment for.

Which length of Treasury Bill should you buy?

Here are the most recent US Treasury Bill auction rates, although I prefer to look at the Daily US Treasury Bill rates.

Notice how the options are for a 4-week, 8-week, 13-week, 17-week, 26-week and 52-week Treasury Bill. Also, you’ll see the bank discount and the coupon equivalent calculated for you (so you don’t have to do the math on your own!).

If you haven’t looked in awhile you’ll notice the new 17-week Treasury Bill which started in October 2022.

Think about how long you’d like to invest your money and what interest rate you’d get from the T-Bill.

Once you decide which T-Bills to purchase you would open an account through Treasury Direct, if you don’t have one already.

Here are the steps to buy Treasury Bills through Treasury Direct

1. Login to your Treasury Direct account at the Treasury Direct login page.

2. Go to the Buy Direct section.

3. Click on Bills, right underneath Marketable Securities

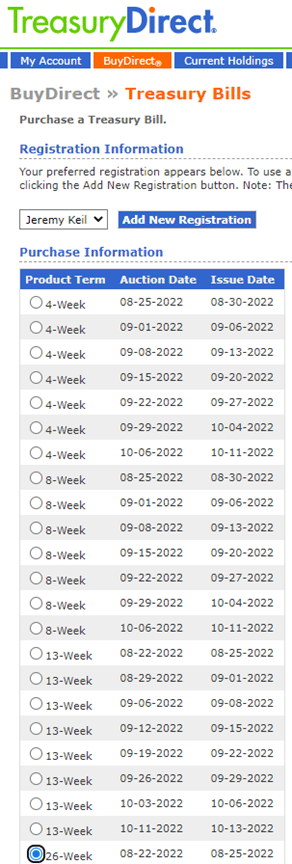

4. Confirm the registration you are purchasing for, and then click on the product term you are looking for. You can do 4-week (1 month), 8-week, 13-week (1 quarter), 17-week, 26-week (6 months) or 52-week (1 year)

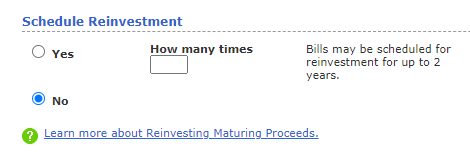

5. Once you have chosen how long you’d like to invest, and how much money you’d like to invest, you would decide if you’d like to schedule a reinvestment.

a. You could just have the T-bill pay back to your bank account when it matures

If you choose this method, then they would pull the needed money from your bank account, at the discount rate. Let’s assume a 5% discount rate for a 26-week $10,000 Treasury Bill. They would pull $9,750 from your account, and then you would receive $10,000 from the proceeds of the Treasury Bill 6 months later.

b. Or you could keep it reinvesting for a period of up to 2 years

If you choose this method the US Treasury will automatically buy a new security of the same type and duration, if available.

Now that you’ve bought US Treasury Bills (T-Bills) through Treasury Direct you can view your investments through the ‘Current Holdings’ section or change things like your upcoming purchases or reinvestments through your ‘Manage Direct’ section.

More Retirement Resources

- Free Retirement Planning Video Course: 5stepretirementplan.com

- CNBC: How to get 5%+ in Treasury Bills

- 3 Things You Should Know Before Choosing A Financial Advisor

- 7 Questions That Could Make or Break Your Retirement

- 5 Ways to Get More Interest on Your Bank Money

- How to buy I Bonds

- When Should I Cash Out My I Bonds?

- 5 Milwaukee Financial Advisors You Need to Know (2023 edition)

- Subscribe to Retirement Revealed Podcast on Google Podcasts

- Subscribe to Retirement Revealed Podcast on Apple Podcasts

- Follow Retirement Revealed Podcast on Spotify

Share:

Listen to Retirement Revealed on: